If there’s one thing the pandemic has done, it generated freight rates that plummeted early, bottoming out somewhere in June, 2020, and have continued a rapid and sustained ascent ever since. Now, in the new year, shippers are managing absences in their workforces and distribution channels while trying to set budgets that incorporate realistic cost projections for both international and domestic transportation.

As Lunar New Year approaches with the usual crush of cargo before weeklong closures of customs and factories, we’re all looking ahead and asking the question, “So…how much?”

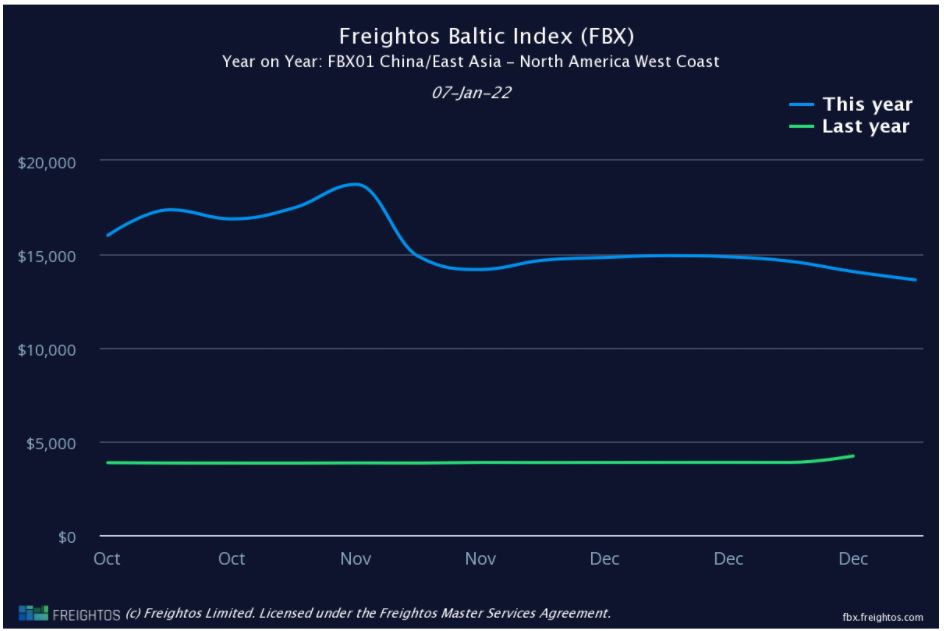

This week, the AJOT published a summary of forecasting from Freightos and reported:

- Asia-US West Coast prices (FBX01 Daily) decreased 14%. This rate is 218% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) dipped 1% to $16,495/FEU, and are 232% higher than rates for this week last year.

Discussions that we are having with our contracted carriers are reflecting that the trend is not downward in a sector that generated profits rivaling that of tech titans in 2021.

However, there are new and interesting financial instruments that could come into play in 2022 to alleviate the pressure on rates which are four to five times as high today as they were a year ago.

Futures contracts seek to hedge the risk of ocean freight rates and are debuting on the Chicago Mercantile Exchange at the end of February.

The Journal of Commerce (paywall), reports, “The daily price of the futures contract will settle against the Freightos Baltic Index, a container rate tracking index developed by digital freight booking platform Freightos and the Baltic Exchange, the 277-year-old, London-based provider of shipping rates and indices. The Baltic Exchange said in a separate statement that trading is expected to begin Feb. 28, with the first contract month for trade being March 2022, pending regulatory review.”

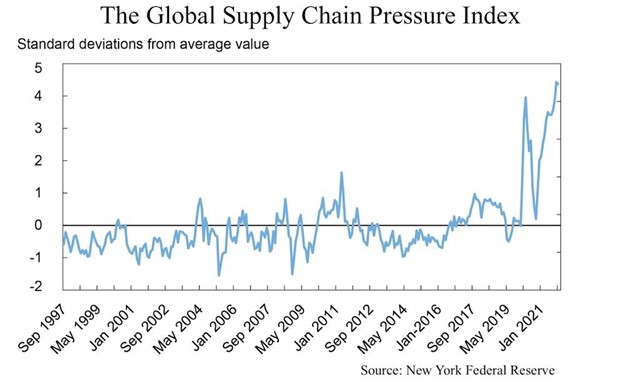

Increasingly, indices and aggregated data points are coming together to give buyers guidance on what to expect. It’s capacity, demand and even quantified pressures. The New York Federal Reserve has developed the Global Supply Chain Pressure Index (GSCPI) that includes data points from the Baltic Dry Index, air freight prices and a host of Purchase Manager Index (PMI) surveys from around the world.

Much to the sector’s chagrin, the end of this chart looks a lot like the past thirty or so days of worldwide omicron infections as well.

For a final source, we turn to well-respected Drewry Shipping Consultants who are telling their BCO customers to, “plan for another year of container supply chain shortages and very elevated ocean rates.” This is based on continued COVID business interruptions, equipment shortages and deteriorated services.

Damas summed it up best saying, “The crisis has turned the ocean transportation sector into both a seller’s market and an inefficient, unreliable sector. Furthermore, shippers pay much more for a deteriorated service—a change which many logistics managers find hard to explain to their company’s leaders.”

At RS Express, we have decades of experience in negotiating, booking and managing ocean freight on our clients’ behalf, whether as their freight forwarder or as their NVOCC. Throughout the pandemic, we have done our best to maintain cordial relationships with our carrier partners, recognizing when they have delivered as promised and also pointing out when their service hasn’t delivered on what we contracted and using that data in further negotiations. Our focus is continuing to represent our customers and their shipping needs and advocating for rate levels that secure equipment, space and reliable transit times between origin and destination.

Follow Us